Article by Margarita Papchenkova. Translation by Nick Trickett.

Vedomosti has examined VEB’s credit portfolio as of the 1st of May. An employee at the state bank revealed a list of loans with names of debtors, the amount of debt, the amount of reserves for the debt, and how bad the debt is. Another confirmed its authenticity. VEB’s press secretary declined to comment on the document, saying that the list is a commercial secret.

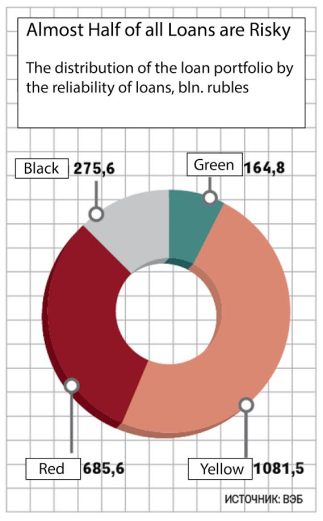

Without accounting for subsidiaries Svyazbank and Globex, VEB has issued 155 loans worth 2.2 trillion rubles. The state bank has divided them into four categories depending on their quality: green, yellow, red, and black. The first two, in the words of a VEB employee, denote good or acceptable loan performance. Red implies a difficult situation while black means a very difficult one – as a rule, default.

Without accounting for subsidiaries Svyazbank and Globex, VEB has issued 155 loans worth 2.2 trillion rubles. The state bank has divided them into four categories depending on their quality: green, yellow, red, and black. The first two, in the words of a VEB employee, denote good or acceptable loan performance. Red implies a difficult situation while black means a very difficult one – as a rule, default.

The credit portfolio attributed to the black category is worth 275.6 billion rubles, but it’s near entirely covered by loss provisions – 251.7 billion rubles (91.3%). For the red category, these figures stood at 685.6 billion, 110 billion, and 16% respectively. Yellow loans are reserved at an even higher average rate of 17.8%. And for many, this figure exceeds 50%. If 51% of the credit is reserved, then it can already be considered problematic, suggests Anton Lopatin, an analyst at Fitch Ratings.

However, last year, VEB received government guarantees worth 547 billion rubles for Ukrainian assets. The bank, for example, credited Russian investors’ purchase of control in the Industrial Union of Donbas, as well as owning the local Prominvestbank. Government guarantees allowed the bank to release reserves, explained an employee from VEB.

“VEB is a development institution, and no one said such an institution should have a good portfolio: it’s often used where business won’t go,” added a VEB employee. On the other hand, there are projects in the real estate section of the portfolio, he remarks, “of which many are in the black zone. What does that have to do with development?”.

On the other hand, there are projects in the real estate section of the portfolio, he remarks, “of which many are in the black zone. What does that have to do with development?”

According to the consolidated financial statements under IFRS for 2016, VEB’s credit portfolio was worth 2.7 trillion rubles, including 2.5 trillion for the parent bank. Of these, 580 billion have been depreciated and 480 billion are overdue. At the same time, nearly 800 billion rubles in provisions for depreciation were created, notes Lopatin. In general, things look better than they did 2-3 years ago. It’s difficult to evaluate just how adequate reserves are, continues Lopatin. Every loan has to be considered individually.

The Central Bank defines 5 categories of borrowers by quality. Depending on the risk, reserves are created for them at 0%, 1-20%, 21-50%, 51-100%, and 100%, comments S & P analyst Sergei Voronenkov. There are hard, formal attributes referring to the categories: for example, if a restructuring took place higher than in third category, it can’t be carried, an expert explains. But the amount of reserves can decrease by the level of collateral. VEB operates without a banking license and can formally not comply with a regulator’s demands, using them only as guidelines, Voronenkov concludes.

Last year, VEB created 510.4 billion rubles in reserves. This led to an annual loss of 111.9 billion rubles. VEB has not yet disclosed how much more it needs to create reserves. Voronenkov calculates that VEB will see profits again next year.

VEB has been used to finance political projects, but the issuance of loans has become toxic, overlaid with funding problems due to sanctions. As a result, at the end of 2015, the bank needed help from the state – 150 billion rubles per year in capital. Now the state betting big on VEB as a source of project financing, but before they can, VEB has to sort out old problems, notes a high-ranking official. VEB prepared three strategies for all its assets: credit, default, and a combination. The first involves a continuation of work with the borrower. The second involves the sale of assets, possibly at a discount, employees of VEB say. Most of the black debts fall under the default strategy as stated in VEB’s materials.

The history of VEB’s fall was presented as an outcome of being overloaded with political assets, but a very large share of bad loans came from pettiness not connected to big politics, says a person whom the government consulted when creating VEB. The top 5 red and black accounts come to about 500 billion rubles, or more than half of all problematic loans. Yet all the rest are small loans, many of them within the range of 10 billion rubles.

“On one hand, the bank itself set up the issuance of loans poorly; there wasn’t any expertise. On the other hand, it was perceived to be an anti-crisis tool and the bank often didn’t take any real collateral,” a VEB employee retorts. VEB is trying to change this and that now, Vedomosti’s source says: it’s reforming its business subdivisions, advancing fixes to loan syndication that will allow co-investment with other investors under the same conditions and under a single deposit.